Seubert risk advisors lay the foundations for business growth.

We help businesses reduce risk exposure.

You may have gotten where you are by taking risks. But long term, your success relies on managing risks. Trust Seubert business risk advisors to analyze the health of your business and identify the risk factors that are affecting your bottom line — before they threaten your business.

We’ll introduce you to new tools and techniques to manage your risk. Plus, we’ll stand by you for years to come – helping you create a culture of risk reduction and long-term cost savings.

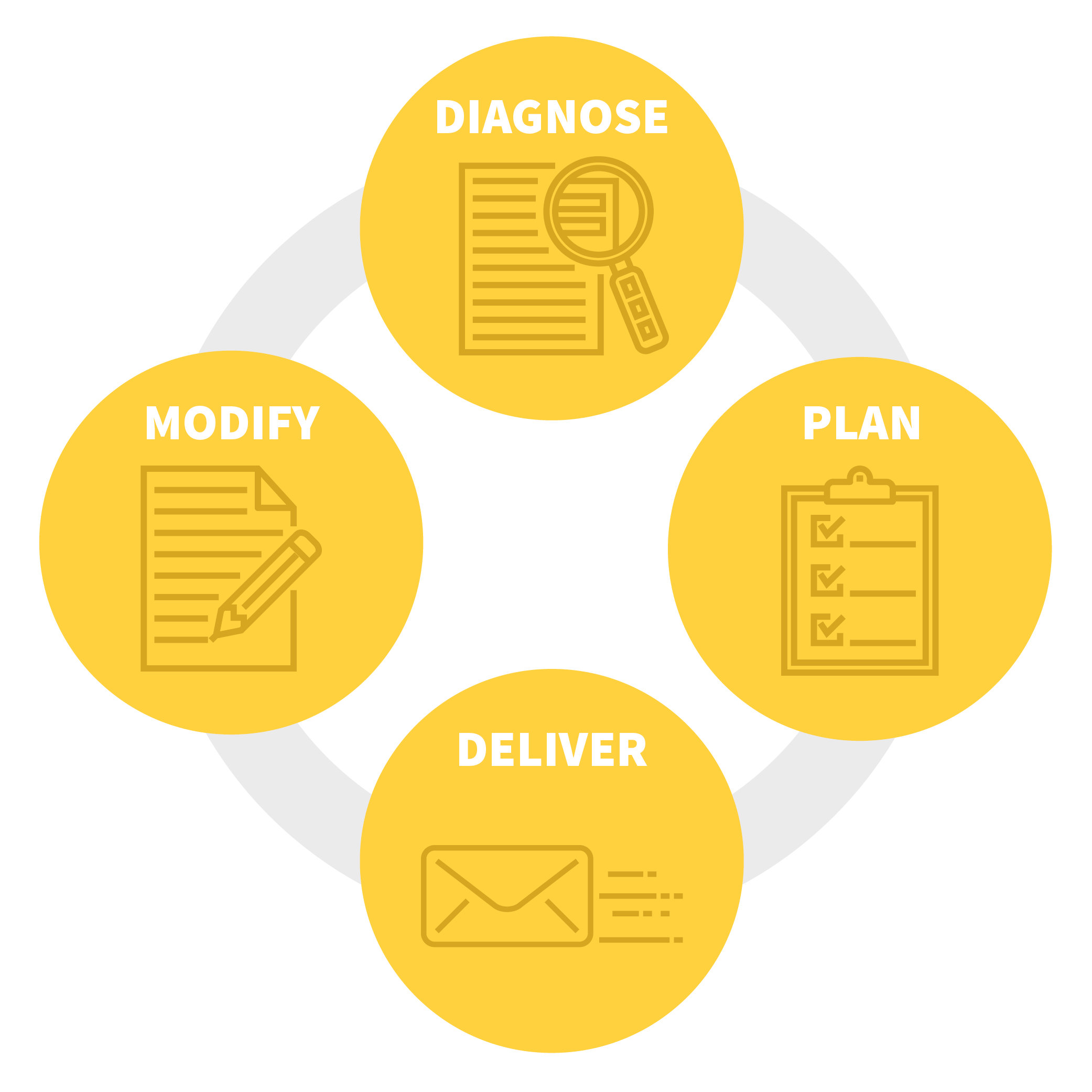

Introducing our SHAPE Process

Seubert delivers individualized solutions for each business. Our unique SHAPE process doesn't just ensure that you have the right coverage. It helps proactively avoid claims. It educates our team about your business so that we can align our risk management strategies with your goals.

- Diagnose

- Plan

- Deliver

- Modify

Learn More

News & Opportunities

The Health Benefits of Walking

April 23, 2024

By boosting physical fitness and enhancing mental well-being, incorporating regular walks into your routine can...

By boosting physical fitness and enhancing mental well-being, incorporating regular walks into your routine can...

Nip Seasonal Allergies in the Bud

April 19, 2024

The Centers for Disease Control and Prevention reports that one-quarter (25.7%) of adults suffer from...

The Centers for Disease Control and Prevention reports that one-quarter (25.7%) of adults suffer from...

Navigating the Roadmap to a Better Renewal

April 18, 2024

Trucking companies are navigating complex challenges, prompting a proactive approach to reduce costs and secure...

Trucking companies are navigating complex challenges, prompting a proactive approach to reduce costs and secure...

“Our goal is to improve

our client’s bottom line.”

our client’s bottom line.”

Brandon Mueller, CRM President